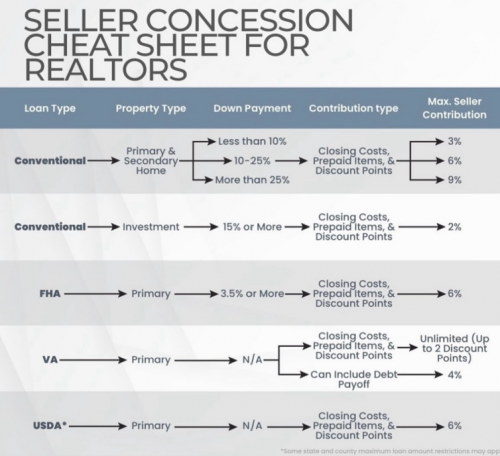

Maximum Seller Concessions:

- Seller concessions are the amount of closing costs, property taxes, and insurance paid by the seller when a home is sold.

- The maximum seller concessions allowable when a home buyer is getting a mortgage determine the limit of assistance the seller can provide.

Importance of Seller Concessions:

- Seller concessions can help buyers with upfront costs and make the purchase of a home more feasible.

- Understanding the limits on seller concessions is crucial for both buyers and sellers in a real estate transaction.

Types of Seller Concessions:

- Common types of seller concessions include the seller paying for the buyer's closing costs, pre-paid interest, and property taxes.

- Negotiating seller concessions can be an important aspect of the home buying process.

Seller Concessions Limitations:

- The limit on seller concessions can vary depending on the type of mortgage and the buyer's down payment.

- Buyers should be aware of these limitations when negotiating a real estate transaction.

Effect on Mortgage Terms:

- Excessive seller concessions can affect the terms of the buyer's mortgage and may lead to complications in the loan approval process.

- Both buyers and sellers should carefully consider the impact of concessions on the overall transaction.

Regulations and Guidance:

- Regulations and guidance from government agencies such as the Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA) provide specific rules on seller concessions.

- Compliance with these regulations is essential for a successful and legally sound real estate transaction.

Professional Consultation:

- Seeking advice from a qualified real estate agent or mortgage professional can help both buyers and sellers understand the implications of seller concessions.

- Professional guidance can ensure that seller concessions are utilized effectively and in accordance with applicable regulations.

Seller concessions, also known as Interested Party Contributions (IPCs), can be used for:

- **Payments or credits related to acquiring the property**, such as:

- Origination fees

- Discount points

- Commitment fees

- Appraisal costs

- Transfer taxes

- Stamps

- Attorneys’ fees

- Survey charges

- Title insurance premiums or charges

- Real estate tax service fees

- Funds to subsidize a temporary or permanent interest rate buydown

- Prepaid items like interest charges, real estate taxes, property insurance premiums, homeowners’ association (HOA) assessments, initial and/or renewal mortgage insurance premiums, and escrow accruals for mortgage insurance coverage

- **Typical fees and/or closing costs paid by a seller in accordance with local custom**, known as common and customary fees or costs, which are not subject to Fannie Mae IPC limits.

Seller concessions cannot be used for:

- Making the borrower’s down payment

- Meeting financial reserve requirements

- Meeting minimum borrower contribution requirements

Additionally, any concessions that exceed Fannie Mae IPC limits are considered sales concessions and must be deducted from the sales price when calculating Loan-to-Value (LTV) and Combined Loan-to-Value (CLTV) ratios for underwriting and eligibility purposes.

Source: Guidelines context provided, specifically the sections "Financing concessions" and "IPC Limits" under "Lender Checklist for IPCs".

Christopher Gibson

NMLS #1910430 | C2 Financial Corp NMLS #135622

Call me: 720-449-6622

Email me: C@ChrisRayGibson.com